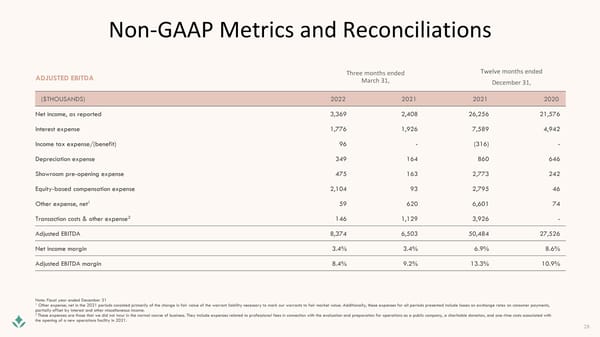

Non-GAAP Metrics and Reconciliations Three months ended Twelve months ended ADJUSTED EBITDA March 31, December 31, ($THOUSANDS) 2022 2021 2021 2020 Net income, as reported 3,369 2,408 26,256 21,576 Interest expense 1,776 1,926 7,589 4,942 Income tax expense/(benefit) 96 - (316) - Depreciation expense 349 164 860 646 Showroom pre-opening expense 475 163 2,773 242 Equity-based compensation expense 2,104 93 2,795 46 Other expense, net1 59 620 6,601 74 Transaction costs & other expense2 146 1,129 3,926 - Adjusted EBITDA 8,374 6,503 50,484 27,526 Net income margin 3.4% 3.4% 6.9% 8.6% Adjusted EBITDA margin 8.4% 9.2% 13.3% 10.9% Note: Fiscal year ended December 31 1 Other expense, net in the 2021 periods consisted primarily of the change in fair value of the warrant liability necessary to mark our warrants to fair market value. Additionally, these expenses for all periods presented include losses on exchange rates on consumer payments, partially offset by interest and other miscellaneous income. 2 These expenses are those that we did not incur in the normal course of business. They include expenses related to professional fees in connection with the evaluation and preparation for operations as a public company, a charitable donation, and one-time costs associated with the opening of a new operations facility in 2021. 28

William Blair Conference | Microsite Page 27

William Blair Conference | Microsite Page 27